A few months ago we bought what was - at the time - the cheapest BEV car available.

By car I mean a proper car that you can drive anywhere like on the Motorway, not a quadricycle or anything like that.

There are now some cheaper ones available for sale on pre-order, with less good features, but the point remains that our car isn't a special one with long range or anything like that. It is just a basic/standard EV.

We have a driveway and can charge the car at home, which is very convenient.

The car has a range of about 200 miles, which is fine for almost all of the journeys that we do.

The only exception is where we go on our annual holiday. We book a cottage somewhere in the UK, and for these trips the journey there and back will certainly exceed the range of the car.

Since we have just had our first such trip (to Pembrokeshire) I thought I would write up the experience.

Part 1: Trip to Wales (Pembrokeshire)

We started with the car at 100%.

The cottage we were staying at was just out of the reach of the car. Well, perhaps we could have made it driving very economically. But we didn't want to take the risk, so had to stop to charge on the way.

When going to stay at a cottage we always stop at a supermarket on the way to pick up our supplies and so I looked for a supermarket with chargers nearby.

Tesla have opened some of their chargers up to non-Tesla owners and they are much cheaper than rival companies, so they are an appealing option.

I found a Tesla location near a Lidl on the edge of Cardiff so we headed there. Katy did the shopping while I charged the car.

While the car was plugged in I managed to have my flask of tea, take the dog for a little walk, and still get back to the Lidl before Katy had finished shopping.

22 minutes charging.

17kwh of electricity for £6.97.

Charging at the destination

The best time to charge is while you are doing something else, like sleeping, eating or shopping.

We booked a cottage which had an EV charger so that we could charge easily enough while parked.

From this charger we took on 41kWh for £19.90 and then (before leaving) 6.92kWh for £4.44.

It was a bit disappointing that we had to download an app, and that the cost was similar to the (much faster) Tesla charger. Also, there was a fee to connect and also an idle fee - a fee for having the car plugged in while fully charged. To me that didn't make sense on a slow charger in the middle of nowhere on private land, but that is the deal that the owner signed up to.

It turned out there were plenty of chargers in car parks we visited so we could have probably got away without booking a cottage with a charger, but it made planning easier and it was one less thing to worry about.

At any rate, it worked and we filled up the car during the stay.

Good job that we filled up too as we used the car most days to go out for walks in the surrounding area.

Journey home

Disappointingly my attempt to leave with 100% was thwarted because for some reason the charger did not charge at its full potential. Plus we packed up and left a little earlier than planned, so we left with 85% charge instead of a full battery.

We aimed for a Tesla charger at Newport (Celtic Manor Resort car park) and arrived with plenty of contingency in case we needed to travel on to the next set of chargers for some reason. I had alternative options planned - Ionity chargers that were more expensive but which I could have paid for out of our Octopus home energy account credit surplus.

Only 17 minutes of charging, and again took on 17kwh of electricity. This time it cost £7.14.

It took less time to get the 17kwh, probably because the battery was at a lower percentage when we arrived. EVs often charge fastest when they are nearly empty.

The A Better Route Planner (ABRP) App indicated that we needed to charge to 68% to arrive home with 10% left (which I wanted to do to provide some contingency).

We had our hot drinks and snacks in the car and then stretched our legs.

Katy was still walking the dog when I disconnected the charger because we reached our target of 68% battery, so I then had to wait for them to return.

We arrived home with 18% battery left so it turned out that charging to 68% was not necessary.

I think this was because I got better efficiency from the car than ABRP assumed. I got 4miles per kWh which is very good for an MG4 doing motorway driving. I just set the Adaptive Cruise Control to 68mph and let the car do the rest, except when there was some overtaking to do when I might have tickled the accelerator to exceed 68mph.

Summary

Overall, my summary would be the following:

- It is perfectly fine to do a long journey in a standard MG4 in the UK. It doesn't have a huge battery or super-fast charging speeds but it has enough of both to be perfectly suitable.

- You may still need to do a bit of planning before going on a road trip with an EV in the UK. Look for rapid chargers on the route, ideally Tesla or others which are cheap, reliable and fast. But there will probably be several suitable options along the route.

Don't leave yourself with only one option in case it is full or broken when you get there! - Tesla chargers are great - no problems at all with the Tesla app (set up with payment card in advance). Lots of other Tesla's there and a couple of other brands of car as well (Volvo, Mercedes).

- It would be good to have more charging options off the motorway. As time goes on there will be more options and they will hopefully then get cheaper due to competition, meaning less planning is required.

- The more people buy electric cars the more incentive there will be for companies to build new rapid chargers for them.

The total cost of charging away from home was £38.45. That would have bought us about 225 miles of petrol in our old hatchback, and we will have got well over 300 miles of driving from the electricity.

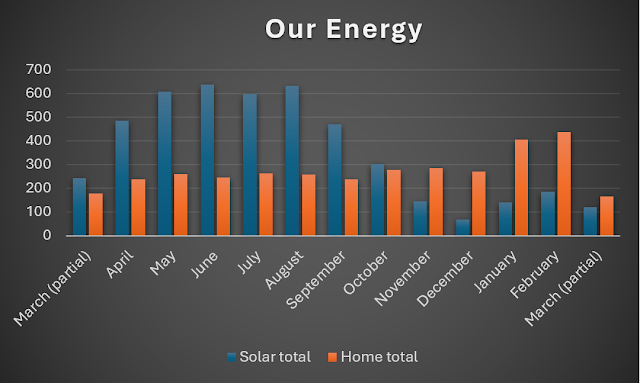

So even on the worst case scenario - charging away from home - it is cheaper to drive an EV than a petrol car. And it is much cheaper to charge at home using our solar panels, which we do for the rest of the year.

So the only real downside of having an electric car turned out not to be a problem at all!